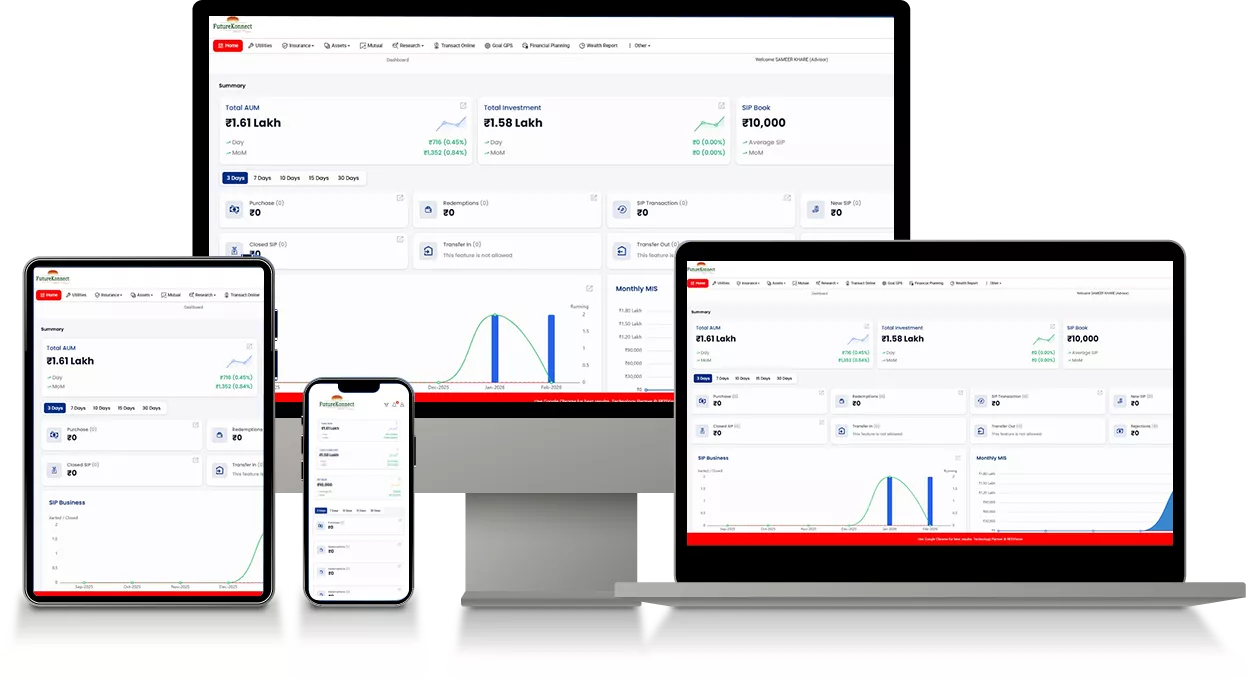

Mutual Fund Distribution Business?

Anyone interested in building a long-term professional journey in the mutual fund space can explore mutual fund distribution. This business offers scope for income potential and gradual growth within a steadily expanding financial market.